do nonprofits pay taxes on utilities

Submit this form to your local assessor with. Most nonprofits have paid staff.

Coronavirus Covid 19 Resources American Public Gas Association

Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas.

. This results in significant savings on monthly utility bills. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing tangible personal property in furtherance of their organizational purposes. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for.

According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on regulated electric natural gas and telecommunication bills. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the nonprofit corporations tax-exempt purposes.

Prepared food and drinks may not be taxable when sold to foreign consular. Prepared food and drinks are not taxable when billed to and paid for by the federal government and its agencies. Some have thousands of employees while others employ a couple of key people and rely on.

Also very often they depend on donations for sustenance and upkeep instead of selling items for a profit. More Arkansas Tax Info. Do nonprofits pay taxes.

Sales and purchases by nonprofit organizations t hat are subject to the 5 state sales or use tax may al so be subject to the. However this corporate status does not automatically grant exemption from federal income tax. Federal and Texas government entities are automatically exempt from applicable taxes.

There are many terms and conditions that come with gaining 501c3 status. But they do have to pay. Very often the only taxes we do not pay are property taxes.

To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to. A 501c3 operating in Illinois may not have to pay Illinois sales tax and it may exempt from real estate taxes on property it owns. 501c3s do not have to pay federal and state income tax.

The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. DLC must have a copy of the Pennsylvania Sales Tax Exemption certificate and the Pennsylvania Holding Exemption certificate on file if you are claiming status as a non-profit organization. Indeed it received 435 million in tax refunds.

To apply for exemptions on local property taxes you must once again be first deemed tax exempt by the IRS. OK the operating principle behind a non-profit is that there is very little profit if any at the end of the year. The biggest benefit of operating a Non-Profit is that they can qualify for.

It is important to contact each utility in. Taxes on money received from an unrelated business activity. In some cases nonprofits that are exempt from property taxes may also be exempt from municipal and county fees such as those for water and sewer.

House Bill 582 which legislates the tax exemption passed the House 121. A 05 county sales or use tax b local exposition taxes and c 05 125 for the City of Wisconsin Dells and the Village of Lake Delton premier resort area tax. Corporation Income Tax Section PO Box 919 Little Rock AR 72203-0919 Information.

The research to determine whether or not sales tax is due lies with the nonprofit. Pepco says the beneficiaries of those refunds were not the companys shareholders but utility customers. However they arent completely free of tax liability.

Nonprofit organizations must apply for exemption with the Comptrollers office and receive exempt status before making tax-free purchases. After being granted this status fill out Form 3ABC which is supplied by your local assessor or obtained from the Planning and Research division of the Massachusetts Department of Revenue. For assistance please contact any of the following Hodgson Russ attorneys.

Due to an emergency clause in this legislation sales of admissions and tangible property sales at fundraising events by all nonprofit groups and governmental organizations are now exempt from sales tax for transactions on or after March 26 2019. Do nonprofits pay taxes. Non-profit exemption A qualifying non-profit organization pays no sales tax on the electricity use.

In short the answer is both yes and no. Even though the federal government awards federal tax-exempt status a state can require additional documentation to. 501 682-7114 Arkansas DFA Website.

Depending on the amount of work a nonprofit corporation does in the community some towns and counties waive utility building or inspection fees. Sales to Government and Nonprofits. Pepco collected nearly 546 million from customers to cover its income tax bill for the years 2002 through 2004.

However organizations that have an E number are liable for excise taxes such as the Electricity Excise Tax the Gas. These nonprofit governmental and civic organizations will no longer charge sales tax on these types of. Paid to the State of Florida.

Answer 1 of 2. Nonprofit organizations obtain tax-exempt status in order to not have to pay taxes. If I want to apply for tax exemptions in Arkansas where do I send my forms when I complete them.

Paid to municipalities andor counties in exchange for the government not creating an electric utility of its own that would compete with your utility. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Most sales of food and beverages to governments are taxable.

The company collects these taxes and distributes them to the proper government entities. Employment taxes on wages paid to employees and. Of Finance Admin.

There are some instances when nonprofits and churches are still required to pay taxes. Approximately 256 of your bill. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases.

There are some instances when nonprofits and churches are still required to pay taxes. Yet the parent Pepco Holdings did not pay income taxes during those years. Gross Receipts Tax.

However there are some situations where sales tax is not due.

Readablebest Of Sales Tax Worksheet Salestaxbycity Salestaxdecalculator Salestaxharyana Budgeting Worksheets Budget Spreadsheet Budget Spreadsheet Template

Recurring Autopay Utility Payments And Services Citybase

Payment Kiosks For Utilities And Government Citybase

Electric Utilities Sector Supplement Global Reporting Initiative

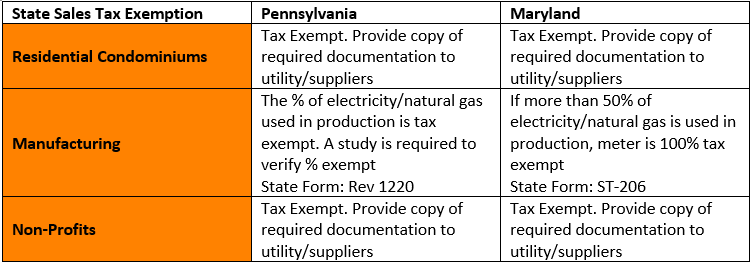

Tax Exemptions For Energy Nania

Call 211 Texas For Utility Assistance To Help You Pay The Light Bill

Transportation Utility City Of Wisconsin Rapids

Providing Essential Utility Services During Covid 19 Payments And Relief

Utility Bills 101 Average Cost Of Utilities Move Org Gas Bill Budgeting Electricity

Blue Layouts Weekly Cash Flow Template Free Layout Format 1f4034fd Resumesample Resumefor Cash Flow Statement Statement Template Cash Flow

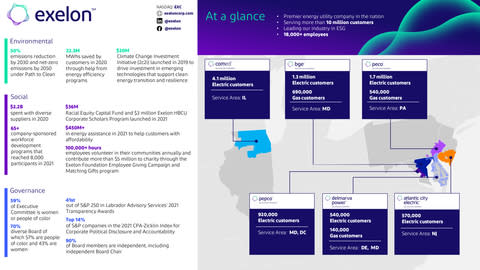

Exelon Completes Separation Of Constellation Moving Forward As Nation S Premier Transmission And Distribution Utility Company

Nonprofit Project Budget Template Seven Doubts About Nonprofit Project Budget Template You S Budget Template Budgeting Worksheets Budgeting

Avoid Utility Disconnection 63 Day Exemption In Texas For Medical Needs

Houston Utility Assistance Find Help To Pay Your Light Bill 2021

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Five Rules For Buying A House And How Far You Can Bend Them Buying A New Home Life Hacks Home Improvement

2 Companies Offering No Deposit Electricity In Baytown Tx 2020